Turo Profitability Calculator for New Hosts

If you’re considering becoming a Turo host, you might be wondering how much money you can make on Turo. Fortunately for you, we built a Turo profitability calculator to help you calculate just that.

If you’re already on Turo and want to know how much you’re making, then head on over here because THIS blog post is for you! (LINK)

At the foundational level, your revenue on Turo is determined by 3 things:

- Your daily rate

- Your vehicle’s daily utilization

- Your protection plan

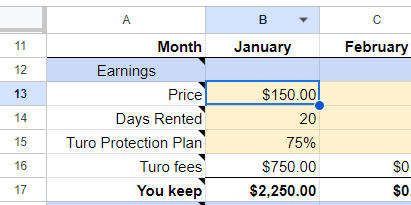

As a math equation, it is Rate x Utilization x Protection plan.

That could look like $100 (daily price) x 20 (days) x .85 (“85 Plan”) = $1,700 per month

Let’s break down how that works. As a vehicle owner, or host, you put your vehicle on the platform, set your daily price and protection plan level.

A person looking to rent a vehicle, or guest, then books your vehicle through the platform. Both the host and the guest pay a small fee to Turo for facilitating the transaction and for providing insurance. As a host, the fee you pay is determined by your protection plan.

Before we dive in you can grab your copy of our FREE Turo Profitability Calculator here: https://carsharepro.ck.page/turocalculator

How To Decide your Daily Rate

An easy high-level way to see what your vehicle could make is to select your location and vehicle’s worth on the Turo’s Carculator here: https://turo.com/us/en/carculator

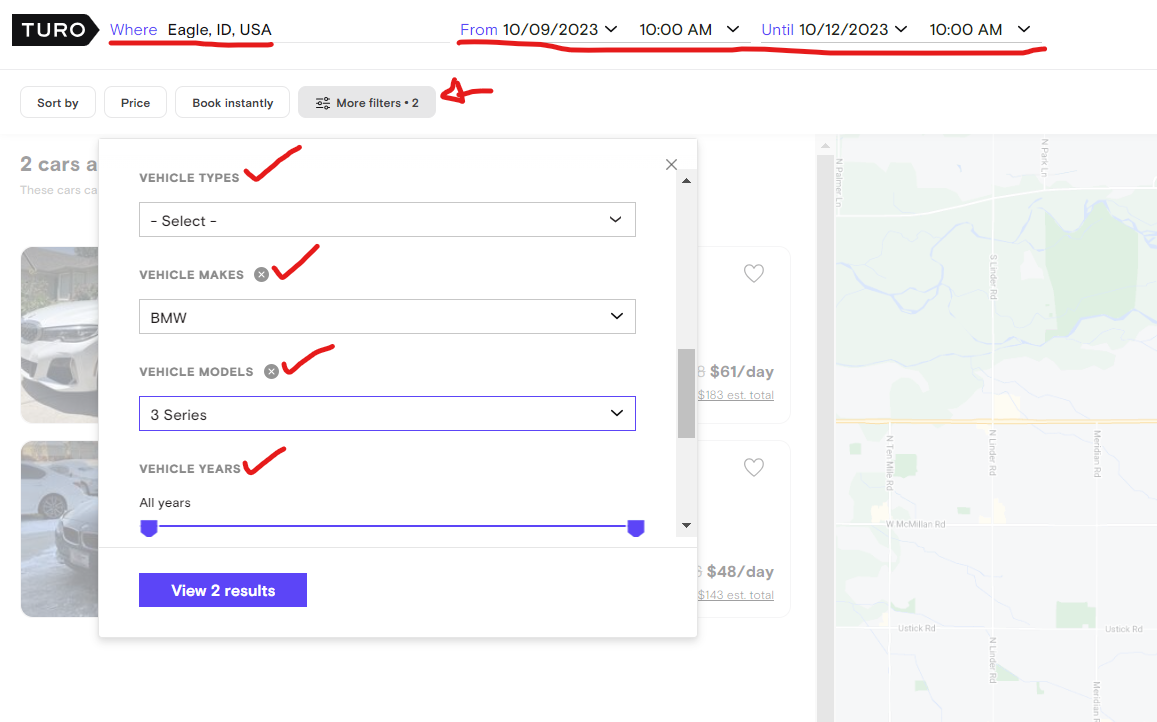

However, you’ll likely find that the Carculator doesn’t have every region nor every vehicle model. So, the next best way would be to simply search the area where you’re considering hosting to see the rate for which vehicles like yours are renting. Simply go to Turo.com and search your location, try a few different date ranges (midweek, weekend, 3 day trip, 7 day trip, different month, high season, low season, etc.) for your exact vehicle. Note the vehicle models option is hidden until you select a vehicle make. If you don’t find your exact vehicle then you can check similar vehicles under “vehicle types”.

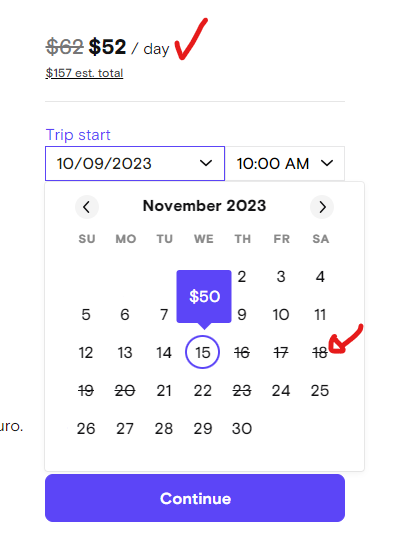

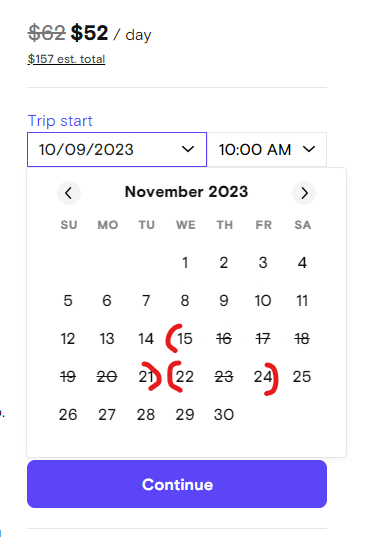

Once you have found comparable vehicles, you can check how busy or rented they are by looking at each vehicle’s calendar.

The rate at the top of this screenshot is the rate for the days you searched. If the date is crossed out (16-20, 23 November in this example) then the vehicle is reserved on those dates. We don’t know what those reserved dates rented for, but by hovering over any non-crossed out date (like 15 in the screenshot) we can see the rate for that day. So, by hovering over the beginning and ending of a crossed out section we can typically get a good idea of the daily rate the vehicle is renting for.

After you’ve checked Turo’s Carculator and your local area you should have a decent idea about the going rate for a vehicle like yours.

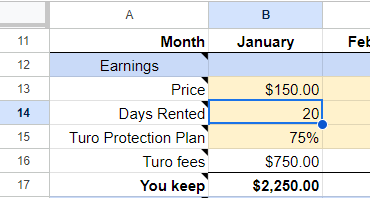

On our spreadsheet, your daily price goes here:

How To Estimate your Utilization (Days Rented)

In the screenshot below, it appears that this vehicle is only rented out for 6 days during the entire month of November. But keep in mind Turo only crosses out the date if the ENTIRE DAY is reserved. So, the vehicle is likely reserved for some part of the day 15 November through some part of the day 21 November. Same thing for the 22-24 November trip.

Turo doesn’t cross those dates out because the guest is probably picking up the vehicle on the evening of the 15th and dropping it off in the morning of the 21st. So technically the vehicle is available the morning of the 15th and the evening of the 21st. Same thing for the morning of the 22nd and evening of the 24th.

On our spreadsheet, your utilization number goes here:

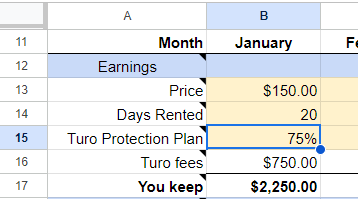

How To Determine your Protection Plan Cost

As a host, the fee you pay to Turo is determined by the protection plan level you choose. If you choose the highest plan, the “90 plan”, you will keep 90% of your vehicle’s earnings but will have fewer protections against wear and tear or accidents. If you select the lowest plan, the “60 plan”, you will only keep 60% of the vehicle’s earnings but will have much more protection against wear and tear and accidents. Between those two extremes you also have the 75, 80, and 85 plans. The higher the plan, the more money you keep. But also, the higher the plan, the more you might have to pay out of pocket for damages done to your vehicle. You need to select the plan you are most comfortable with based on your own risk/reward tolerance. For additional reading, here is Turo’s description of each plan level https://help.turo.com/en_us/summary-and-cost-of-protection-plans-or-us-hosts-ryy_U4gE9

Basically, if you are on the 90 plan you keep 90% and Turo keeps 10%. If you are on the 60 plan you keep 60% and Turo keeps 40%. You get it. You need to know this number in order to determine your potential earnings.

On our spreadsheet, your protection plan number goes here:

How To Estimate your Expenses

There are many direct costs that come with renting a vehicle. The most common expenses are vehicle loan payments, insurance, parking costs, car washes, and vehicle repairs. There are expenses, such as depreciation, indirect costs, and taxes, but those topics are probably too tricky for this blog post. Let’s just stick to the common expenses and taxes since we can closely estimate those.

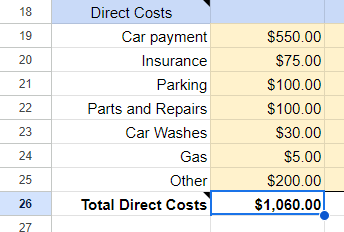

On our spreadsheet, your expenses go here (make sure to enter them as positive numbers):

These are the actual rounded numbers from one of my vehicles for one month of Turo.

- My car payment is fixed at $550 per month

- My insurance is part of a larger insurance package, but this vehicle’s portion is around $75

- My parking expenses are usually around $10-$20 per trip, depending on how quickly I get around to picking it up from the airport parking lot after a guest’s trip

- My parts and repairs are around $100 in miscellaneous fixes and replacements, anything left over stays in the budget for the next month

- My car washes might be $30 if I have to take it to the car wash 3 times, I hand wash most of the time unless the car is super dirty

- My gas expense is very low because I live close to the airport and I rarely need to top it off between guests

- My other is just a maintenance budget for any large fixes, or to set aside for downtime in case of an accident or other issues

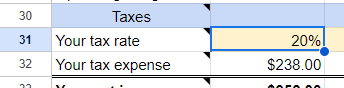

The only other expense you can predict is your taxation rate. Generally 20% is a good estimate unless your CPA tells you otherwise.

On our spreadsheet, your tax rate goes here:

What’s a Good Return On Investment (ROI)?

Well, that depends on your perspective and the opportunity cost of other investments or work you could be doing with your time. For me, an active income (meaning I have to personally be involved with my effort and time) with an ROI below 20-30% might not be worth the extra work. My index Mutual Funds and ETFs return an average of 9-12% entirely passively. So if I’m making 20% on Turo with lots of effort, but making 12% on ETFs entirely passively, then is it worth the extra 8% (20-12%) for me to engage in this activity? That’s a question you might consider asking yourself.

A 10% ROI looks very different If this is your full time job and you’re profiting $200,000 per year on $2,000,000 of Turo income.

At the end of the day any positive ROI is a good thing. But only you can determine what a good ROI is for your situation, opportunity costs, and level of involvement.

Download our FREE Turo Profitability Calculator and get started today!